.png)

.png)

Takeaway

After the Dragon Boat Festival, steel prices in the futures market hit a small peak. Spurred by news of "improving special bond issuance" and counter-cyclical adjustment of macro policies, the expectation of increasing infrastructure investment triggered a general rise in the black market. And rebar in out of the double needle after dip, reparative bounce, boost market confidence, to a certain extent, but considering the off-season market, stock picks up, the contradiction between supply and demand of spot increasing factors such as, upside is limited, at the same time, the upstream regression strong iron ore prices supported by the low inventory, steel mills profit squeeze, further shipments sentiment remains strong.

One, market trend

1. Futures market

After the Dragon Boat Festival, the futures market generally turned black, iron ore rose more than 5 percent. On the news, vale's closure of nine tailings DAMS in Brazil and expectations of infrastructure investment have driven up prices, but the underlying cause is tight iron ore supply and demand, tight supply due to the continued decline in port inventories, and strong spot prices, supporting a strong return of futures prices.

By the upstream raw material price support, rebar since May 22, a drop in prices, after the Dragon Boat Festival double needle dip, ushered in a wave of rebound, June 12 after the previous day after a small fall back adjustment, 13 have to supplement the space, but overall did not change the shock pattern.

2. Spot market

After the holiday, the spot market rose and fell, the recovery of the future market brought a certain boost to the spot market, but most traders are cautious, take goods is not strong, especially in the background of the continuous squeeze of profits, generally in a wait-and-see situation. Judging from the market feedback, the recent resources still have the trend of accelerating the arrival of goods, steel mills did not appear obvious signs of production cuts, future inventory pressure will gradually highlight, strong willingness to ship.

On June 10, the average price of rebar 20mm HRB400E in 24 major markets nationwide was 4021 yuan/ton, which was 19 yuan/ton lower than the previous trading day. On June 11, the average price of rebar 20mm HRB400E in 24 major markets nationwide was 4015 yuan/ton, 1 yuan/ton lower than the previous trading day. On June 12, the average price of rebar 20mm HRB400E in 24 major markets nationwide was RMB 4,028 / ton, 8 yuan/ton .

Two, Influencing factors

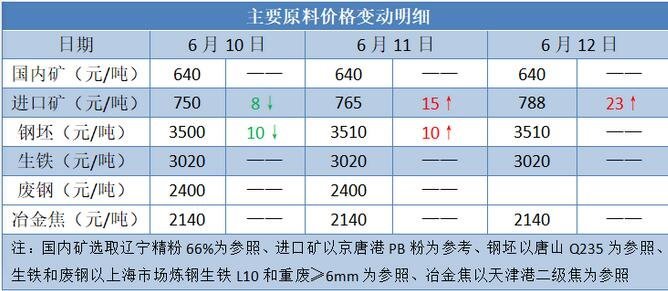

1, upstream raw material prices remain high support steel price trend

At present, the upstream iron ore, coking coal, coke and other raw materials market prices remain high, the spot market has followed up, at present from the market feedback, the average production cost of steel mills increased by 300 yuan/ton or so, the future will form a certain support for steel prices.

2. Downstream demand is weak and counter-cyclical adjustment forms support

Due to the weak downstream demand, steel mills experienced high production, high cost, low inventory in May after the fundamental pattern, in order to timely shipment, the price showed a general reduction pattern.

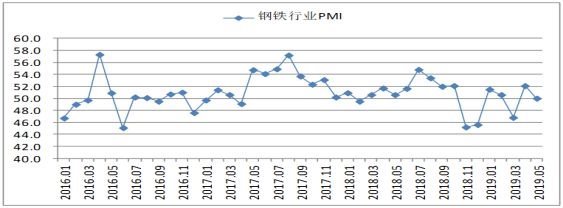

June macro, on the one hand, will continue to be affected by the trade situation exports. Data from the general administration of customs showed that China exported 5.743 million tons of steel in May, down 16.5 percent year-on-year. May, on the other hand, the world's major manufacturing PMI data are a significant drop in the downstream demand, the material union steel logistics professional committee released may PMI is located in the point of 50.0%, iron and steel industry and the sub-index, production index, the index, the index of import purchase quantity, purchase price index has increased, but the new orders and new export orders, raw material stock index fell, heralding the production enterprise continues to expand, but the decline in market demand growth, at the same time, the raw material cost pressures.

It is important to note that with the global economy downward pressure, the world's major central bank's monetary policy stance toward easing, countercyclical regulation of monetary policy in our country strength may increase, coupled with a steady growth of various types, such as tax cuts JiangFei policies, including the recent "allows special bonds for major projects capital" of infrastructure investment, as well as the major project investment plans, such as policy support, market outlook infrastructure investment increase is expected to bring certain support to steel market.

3. With the continuous increase of production, relevant departments have maintained a high pressure on the new production capacity

Statistics show that in the first quarter of this year, China produced 231 million tons of crude steel, up 9.92 percent year-on-year, and 269 million tons of steel, up 10.82 percent year-on-year. China's crude steel output reached 85.03 million tons in April, up 12.7 percent year-on-year. According to cisa data, the crude steel output of key steel enterprises in mid-may was 2.038 million tons per day, down 0.38% from the previous ten days, and the steel inventory of key steel enterprises was 12.683 million tons, up 1.81% from the end of the previous ten days.

Recently, the blast furnace operating rate is stable, and the capacity utilization rate of 247 steel mills is 85.05%, increasing by 0.68% month-on-month. On the whole, in May, steel production continued to rise, sales volume of circulation enterprises fell, inventory digestion slowed, market expectations appeared divergence, and procurement was cautious. Industry sentiment was subdued in June as the leading PMI index fell in May. It is worth mentioning that, in the face of the rising steel production this year, the relevant departments of the state maintain a high-pressure situation, the illegal construction projects to seal, and clearly must improve the environmental protection and other related procedures, strict implementation of the iron and steel industry overcapacity related provisions.

View

Affected by policy factors such as "special bonds can be included in capital of major projects" after the Chinese New Year, the expected demand for infrastructure investment makes the black market generally rise, which has a certain boost to the spot market. On June 12, the average price of rebar 20mm HRB400E in 24 major markets nationwide was 4028 yuan/ton, 8 yuan/ton higher than the previous trading day. But in view of entering the traditional off-season, coupled with this year since the production continues to climb, inventory pressure gradually highlighted, some manufacturers continue to cut factory prices eager to ship, downstream demand market did not appear fundamental change, expected future upside space is limited, will continue to maintain wide shock pattern.

津公网安备 12022302000130号 CopyRight@2009-2022Tianjin Boai Pipeline Group All Rights Reserved Technical Support:鲸驰蓝海

津公网安备 12022302000130号 CopyRight@2009-2022Tianjin Boai Pipeline Group All Rights Reserved Technical Support:鲸驰蓝海